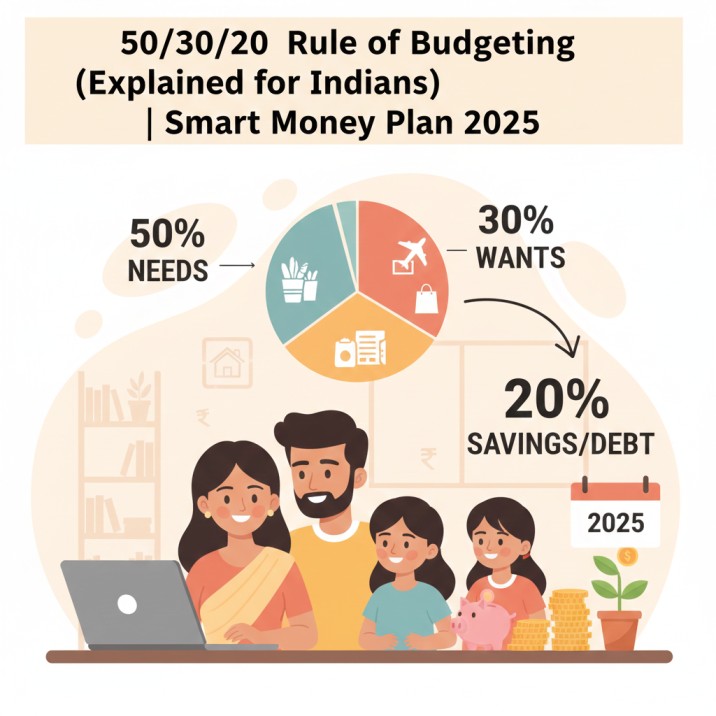

Understand the 50/30/20 budgeting rule for Indians in 2025—spend 50% on needs, 30% on wants, and save 20% for future goals to balance life and finances.

In bustling cities like Bengaluru, with rents and living costs climbing ever higher, budgeting isn’t just smart—it’s necessary. A viral story on Reddit highlighted a 22-year-old engineer managing to live comfortably on ₹20,000/month in Bengaluru, using sensible allocation and clever hacks like room sharing, public transport, and DIY meals.

His expense breakdown? ₹8,000 on food, ₹9,000 on rent, ₹2,000 on travel, and ₹2,000 for essentials. While he chose a no-frills lifestyle, his monthly discipline and sacrifices resonated with Indians across income brackets facing city inflation and stagnant wages.

Understanding the Buckets: Indian Examples

50% for Needs

These include:

- Rent or home loan EMIs

- Groceries and daily essentials

- Utility bills (electricity, water, internet)

- Health and term insurance premiums

- School/college fees for kids

- Minimum loan repayments

A practical example: If someone’s after-tax income is ₹60,000, then needs get ₹30,000/month.

30% for Wants

Think of:

- Eating out and takeaways

- Movie nights, streaming subscriptions

- Short trips, OTT platforms

- Shopping (clothes, electronics, gifts)

- Hobbies and personal upgrades

For the same ₹60,000 income, wants get ₹18,000.

20% for Savings

Includes:

- SIPs in mutual funds

- Recurring deposits or FDs

- Emergency fund for medical or job loss

- Retirement schemes (EPF, PPF)

- Insurance-linked investments

For ₹60,000, this equals ₹12,000 per month.

Detailed Table: 50/30/20 Rule Example

| Category | Monthly Budget (₹60,000 income) | Typical Expenses (India) |

|---|---|---|

| Needs (50%) | ₹30,000 | Rent, groceries, bills, insurance |

| Wants (30%) | ₹18,000 | Dining, travel, shopping |

| Savings (20%) | ₹12,000 | SIP, RD/FD, emergency fund |

Step-by-Step Guide to Applying This Rule

1. Calculate after-tax income: Check recent payslips or bank deposits.

2. List monthly expenses: Sort items into needs, wants, and savings.

3. Set thresholds: Use the percentages (50-30-20) to fix category limits.

4. Evaluate and adjust: Use mobile apps or Excel to track. Cut excesses (say, overspending on OTT subscriptions or impulse buys).

5. Automate: Arrange for automatic investment deductions and bill payments.

Real-life Story: Budgeting as a Bengaluru Graduate

Six months ago, Adarsh moved to Bengaluru with just ₹20,000/month to spare. Splitting rent with friends, taking Rapido rides instead of buying a car, and opting for home-cooked meals helped him make ends meet, leaving a bit for savings.

He skipped costly weekend outings, lived within his means, and posted his expense story online. The post drew responses from others facing even higher expenses—and sparked a conversation about priorities and life choices for young Indians in fast-changing cities. Some advised spending more for joy and personal growth in one’s 20s; others shared their own struggles or hacks.

This is budgeting in action, Indian style—practical, adaptable, and sometimes, a little bit philosophical about what truly counts.

Benefits of 50/30/20 Rule (for Indian Families)

- Promotes discipline: Fixed percentages check impulsive spending, especially for newly working professionals.

- Simple and flexible: No complex math, just percentage allocation—easy with any income.

- Encourages savings: The 20% savings bucket ensures a buffer and long-term planning.

- Helps identify waste: Regular tracking highlights recurring unnecessary expenses.

FAQs

Q1: What counts as a “want” versus a “need”?

A “need” enables living and earning (housing, food, bills, insurance, EMIs). A “want” enhances comfort but isn’t essential (dining, movies, gadgets, gym memberships).

Q2: How to save if income is low?

Focus on percentages, not amounts. Saving even ₹500/month consistently adds up. Try automating transfers right after pay-day to avoid temptation.

Q3: Can I include loan repayments?

Yes, minimum repayments go into the “needs” bucket. Any extra repayments could go in “savings”.

Q4: Should I adjust the percentages?

Absolutely. Life situations differ—families in Tier-2 cities may need 60% for needs, bachelors might manage with 40%. The key is regular review and adjustments.

Q5: External tools and calculators?

Try budget calculators at Groww, ICICI Prudential, YES Bank, NerdWallet, and Reddit India Personal Finance.

Useful External Resources

- ICICI Prudential 50/30/20 Guideiciciprulife

- Groww Budget Rule Articlegroww

- Reddit India Personal Finance Forumreddit

- NerdWallet Calculatornerdwallet

- YES Bank Budgeting Tipsyesbank

Short Story With a Personal Touch

Meet Priya, a 32-year-old doctor in Chennai. She grew up in a house where budgeting was unheard of—every festival, every family function meant spending all her salary. She started using the 50/30/20 rule after her first year of earning, realizing her wardrobe was full but her savings nearly empty.

Within a year, Priya tracked her expenses, distinguished “wants” from “needs,” and automated ₹15,000 into mutual funds and FDs monthly. She ended up saving money for a Europe trip, built a modest emergency fund, and discovered budgeting wasn’t about denying herself, but choosing what truly mattered.

Her tip: “Keep your budget flexible, but don’t let your savings slide. Small, steady progress gave me confidence—and freedom!”

Final Advice

Budgeting with the 50/30/20 rule offers Indians a realistic, practical way to balance daily expenses, enjoy life, and prepare for tomorrow. Whether you’re in metro hustle, small-town routine, or starting a family, smart budgeting can support not just your wallet but your peace of mind.

Disclaimer: This article is based on personal experience and is for educational purposes only. It does not constitute financial, investment, or legal advice. Readers are advised to do their own research or consult a qualified professional before making any financial decisions.