And How to Stop It Without Feeling Restricted

Ask any Indian family this question:

“Do you overspend every month?”

Most people will say no.

Now ask a different question:

“Can you clearly explain where every rupee went last month?”

That’s where silence begins.

The truth is, most Indian families overspend ₹2,000 or more every month — not on luxury, not on big purchases, but through small, unnoticed habits that feel harmless.

₹100 here.

₹50 there.

“Just this once” decisions that quietly add up.

In 2025, when expenses rise faster than income, fixing these leaks matters more than earning extra.

Why Overspending Feels Invisible in Indian Households

Indian spending habits are unique.

We:

- Spend in cash and UPI

- Make frequent small purchases

- Rarely track daily expenses

- Believe “small amounts don’t matter”

That’s exactly why overspending slips through unnoticed.

You don’t overspend in one big decision.

You overspend slowly and repeatedly.

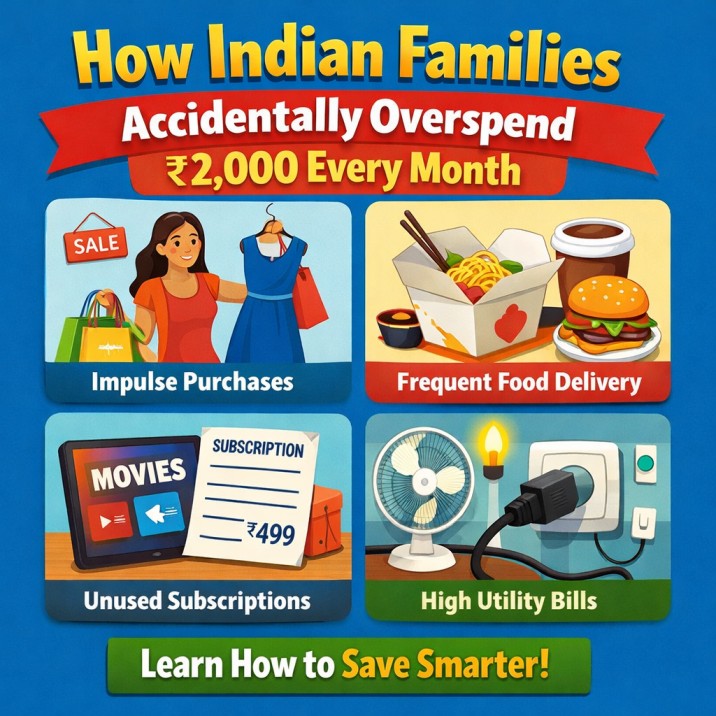

The ₹2,000 Leak: Where It Actually Comes From

Let’s break down the most common areas where Indian families lose money every month — without realising it.

1. Unplanned Food Orders & Snacks (₹600–₹800)

This is the biggest culprit.

- Evening snacks from outside

- Sudden Swiggy/Zomato orders

- “Too tired to cook today” moments

One order feels justified.

Five orders a month quietly cost ₹700–₹1,000.

Most families don’t count snacks as “real expenses”, which is why this leak goes unnoticed.

This habit alone can disturb monthly budgets, especially when groceries are already budgeted, as explained in groceries budget shopping India – smart ways to save every month.

2. Convenience Spending (₹300–₹500)

Convenience spending doesn’t improve lifestyle much, but costs a lot.

Examples:

- Auto instead of walking short distances

- Delivery fees instead of pickup

- Paying convenience charges without checking alternatives

₹30–₹50 per instance feels harmless.

Over a month, it quietly crosses ₹400.

3. Unused or Forgotten Subscriptions (₹200–₹400)

OTT apps, cloud storage, premium apps — many run quietly.

Most families:

- Subscribe during offers

- Forget to cancel

- Don’t check bank statements carefully

₹199 here, ₹299 there — easy ₹300–₹400 gone monthly.

4. Small Impulse Purchases (₹300–₹500)

Impulse spending doesn’t look like impulse anymore.

- Online “flash deals”

- Grocery items not on the list

- “It’s cheap, let’s buy” thinking

These purchases rarely bring long-term value, but they hurt savings.

Shopping without a plan increases spending significantly, which is why list-based buying matters, as discussed in best online shopping tricks to save money.

5. Bank Charges & Fees Nobody Notices (₹150–₹300)

Most families don’t track:

- ATM charges

- SMS alert fees

- Minimum balance penalties

- Small service charges

These deductions feel technical, so people ignore them.

But they quietly reduce your balance every month.

Many families realise this only after checking detailed statements, as explained in hidden bank charges you’re paying every month.

Total Monthly Overspending (Realistic)

Let’s add it up conservatively:

- Food & snacks: ₹700

- Convenience spending: ₹400

- Subscriptions: ₹300

- Impulse buys: ₹400

- Bank fees: ₹200

👉 Total: ₹2,000 per month

That’s:

- ₹24,000 per year

- Almost one emergency fund

- Several months of school expenses

Lost without any major purchase.

Why Families Don’t Feel This Overspending

Because:

- Expenses are spread across the month

- Payments happen digitally

- There’s no “one big bill”

- Income feels sufficient — until it’s not

Money pain is delayed, so habits don’t change.

How to Stop Overspending ₹2,000 Without Feeling Restricted

You don’t need strict rules.

You need small awareness-based changes.

Step 1: Weekly Expense Check (10 Minutes)

Monthly reviews are too late.

A weekly check:

- Shows leaks early

- Allows quick correction

- Reduces guilt and stress

This approach works better for families than strict monthly tracking, as explained in weekly budget vs monthly budget – which works better.

Step 2: Fix Just One Category First

Don’t try to control everything.

Pick one:

- Food orders

- Subscriptions

- Impulse shopping

Fixing one category often saves ₹500–₹800 immediately.

Step 3: Create a “Small Expenses” Awareness Rule

Every time you spend under ₹100, pause for 5 seconds.

Ask:

- Do I really need this?

- Will I remember this tomorrow?

This pause alone reduces unnecessary spending.

Step 4: Redirect the Saved ₹2,000 Immediately

Don’t let saved money sit idle.

Use it for:

- Emergency fund

- SIP

- RD

- Education savings

If savings feel difficult, this practical guide on how to save ₹5,000 every month without sacrifice shows how small changes add up.

A Short Real-Life Family Example

A family of four in Nagpur noticed their bank balance always felt tight despite no big expenses.

They tracked expenses for two weeks:

- Food orders: ₹900

- Random shopping: ₹500

- Subscriptions: ₹299

They didn’t stop everything.

They just reduced frequency.

Within one month:

- Saved ₹2,200

- Used it to start a small RD

- Felt more control, less stress

No income change.

Just awareness.

FAQs

1. Is ₹2,000 overspending really common?

Yes. For many families, it’s even higher — they just don’t notice it.

2. Do I need to stop all enjoyment to save?

No. You need to reduce frequency, not eliminate happiness.

3. Will tracking expenses daily help?

Yes, but even weekly tracking works well for busy families.

4. What if my income is already very tight?

That’s exactly when fixing leaks matters most.

5. Can students and couples benefit from this?

Absolutely. These habits are easier to fix early in life.

Final Thoughts

Most Indian families don’t need more income.

They need fewer money leaks.

Overspending ₹2,000 every month doesn’t feel dangerous —

until you realise it’s stealing your peace, savings, and future options.

In 2025, financial improvement won’t come from extreme discipline.

It will come from small awareness and consistent correction.

Fix the leaks.

The money will start staying.

Disclaimer: This article is based on personal experience and is for educational purposes only. It does not constitute financial, investment, or legal advice. Readers are advised to do their own research or consult a qualified professional before making any financial decisions.