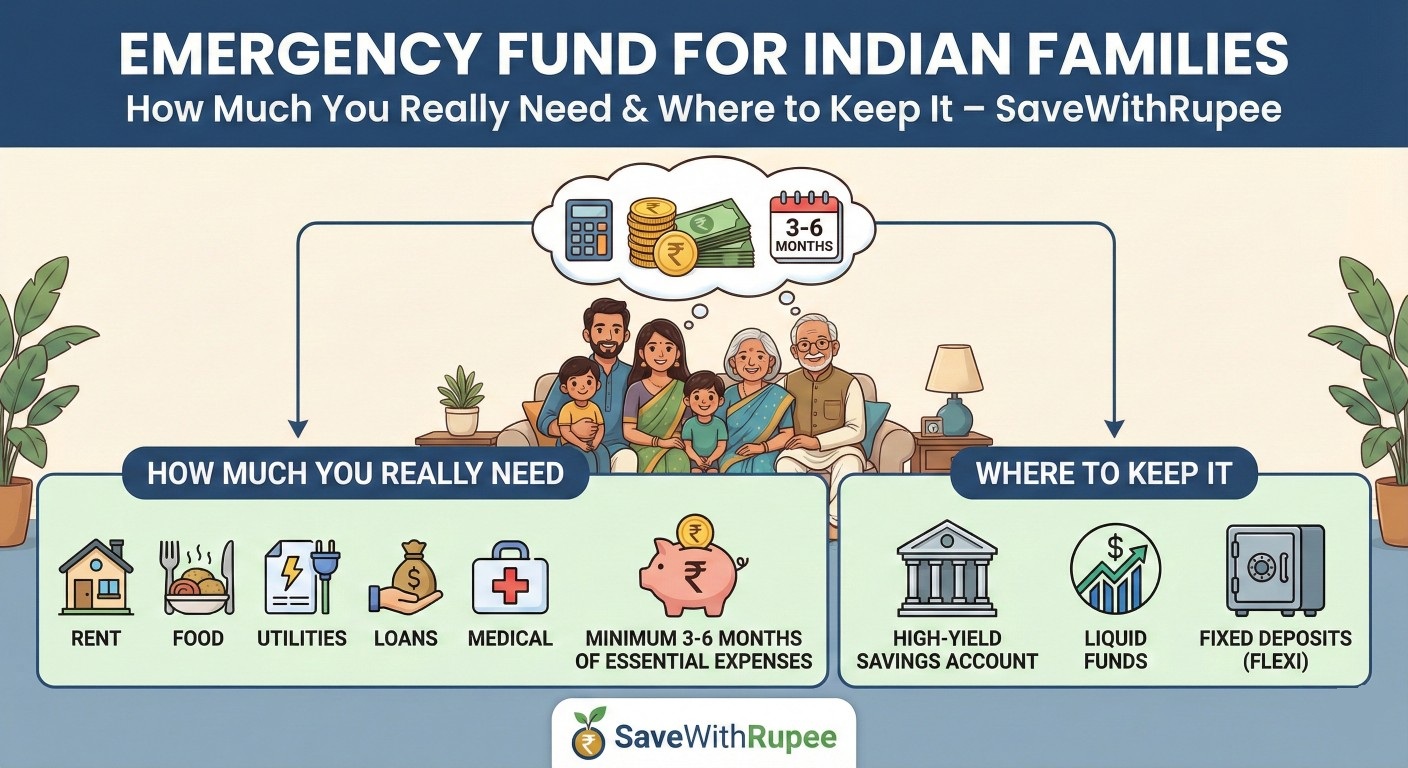

A practical Indian guide to emergency funds with real examples. Learn how much emergency fund Indian families really need, where to keep it safe, mistakes to avoid, myths vs reality, and a step-by-step roadmap.

Emergency Fund for Indian Families

How Much You Really Need and Where to Keep It (Real Indian Examples)

Most Indian families don’t realise the importance of an emergency fund until life forces them to learn it the hard way.

A hospital bill.

A sudden job loss.

A family emergency back home.

And suddenly, all planning collapses.

I learned this lesson not from books, but from fear, panic, and regret.

This article is not about ideal finance theory.

It’s about real Indian households, real salaries, real responsibilities — and how an emergency fund can protect your dignity, peace, and family stability.

What Is an Emergency Fund (In Simple Indian Terms)?

An emergency fund is money kept aside only for emergencies, not for:

- Festivals

- Shopping

- Travel

- Investments

It exists for situations like:

- Medical emergencies

- Job loss or salary delay

- Sudden house repairs

- Family crisis

Think of it as financial oxygen.

You may not use it daily, but without it — survival becomes difficult.

The Day I Realised an Emergency Fund Is Non-Negotiable

Years ago, I faced a sudden medical expense in my family.

No warning.

No time to plan.

What did I do?

- Used credit card

- Borrowed from relatives

- Lost peace for months

That moment later connected deeply with

how money stress affected my life until I changed one habit.

Why Emergency Funds Are Even More Important in India

India is unique.

We deal with:

- Limited insurance coverage

- Salary delays

- Joint family responsibilities

- Medical costs that rise silently

That’s why emergency planning matters more here than in many countries.

Ignoring this is one of the biggest mistakes explained in

financial advice I wish I followed 10 years earlier.

How Much Emergency Fund Do Indian Families Really Need?

Forget generic advice.

Let’s break it down Indian-style.

The Simple Rule (That Actually Works)

👉 Minimum: 6 months of essential expenses

👉 Ideal: 9–12 months for unstable income

Not salary.

Not lifestyle expenses.

Only essential monthly costs.

Real Example With Numbers (Middle-Class Family)

Monthly Essential Expenses

| Expense | Amount (₹) |

|---|---|

| House Rent / EMI | 12,000 |

| Groceries | 6,000 |

| Electricity + Water | 2,000 |

| Transport | 3,000 |

| School Fees | 4,000 |

| Mobile + Internet | 1,000 |

| Medical / Misc | 2,000 |

| Total | 30,000 |

Emergency Fund Calculation

| Duration | Amount Needed |

|---|---|

| 6 months | ₹1,80,000 |

| 9 months | ₹2,70,000 |

| 12 months | ₹3,60,000 |

This exact calculation approach is also discussed in

how much emergency fund an Indian household really needs.

Real-Life Story #1: IT Employee With No Backup

Salary: ₹60,000

Emergency fund: ₹0

Lost job during layoffs.

Result:

- Used credit cards

- Broke investments

- Stress affected health

Lesson learned too late.

Real-Life Story #2: Auto Driver With Small Emergency Fund

Monthly income: ₹25,000

Emergency fund: ₹80,000

Faced accident repair + hospital bill.

Result:

- No borrowing

- Continued work

- Mental peace

Emergency funds don’t depend on income size — only discipline.

Myth vs Reality (Emergency Fund Edition)

| Myth | Reality |

|---|---|

| I have insurance | Insurance doesn’t cover everything |

| My job is secure | No job is permanent |

| I’ll manage somehow | “Somehow” usually means debt |

| Emergency funds reduce growth | They protect long-term wealth |

Step-by-Step Roadmap to Build an Emergency Fund

Step 1: Calculate Monthly Essentials

Exclude luxury expenses.

Step 2: Fix a Monthly Contribution

Even ₹1,000–₹3,000 is fine.

Step 3: Automate Savings

Treat it like a bill.

Step 4: Keep It Separate

Never mix with daily spending.

This saving-first habit aligns perfectly with

the only money system an Indian family needs.

Where Should Indian Families Keep Their Emergency Fund?

This is crucial.

Best Places (Ranked)

| Option | Safety | Liquidity | Returns |

|---|---|---|---|

| Savings Account | High | Very High | Low |

| Liquid Mutual Fund | High | High | Moderate |

| Sweep FD | High | Medium | Moderate |

| Cash at Home | Low | High | Zero |

Editor’s Pick ✔

👉 Savings account + Liquid fund combination

Never keep emergency funds in:

❌ Equity mutual funds

❌ Stocks

❌ Crypto

❌ Locked FDs

Real-Life Story #3: Freelancer With Variable Income

She followed advice from

how to manage money when your income changes every month.

Built 9 months emergency fund.

Result:

- No panic in low-income months

- Confidence to say “no” to bad work

Common Emergency Fund Mistakes Indians Make

- Mixing it with savings

- Using it for festivals

- Investing it for higher returns

- Not replenishing after use

- Depending fully on credit cards

Many of these mistakes also hurt people later while investing, as explained in

mistakes to avoid while starting SIP.

Do vs Avoid Table

| Do | Avoid |

|---|---|

| Keep fund liquid | Locking money |

| Use only for emergencies | Lifestyle spending |

| Refill after use | Ignoring depletion |

| Separate account | One-account chaos |

Real-Life Story #4: Family With ₹30,000 Income

They followed budgeting basics from

monthly budget plan for family with ₹30,000 income in India.

Built ₹1.5 lakh emergency fund in 18 months.

Emergency Fund Checklist (Save This)

✔ Monthly essentials calculated

✔ Target months decided

✔ Separate account created

✔ Automated transfer set

✔ Usage rules defined

✔ Refill plan ready

Pros & Cons of Emergency Fund

Pros

- Mental peace

- No debt dependency

- Financial confidence

- Family security

Cons

- Low returns

- Needs discipline

Peace is worth more than returns.

Real-Life Story #5: My Own Transformation

After building my emergency fund:

- I stopped fearing month-end

- I invested calmly

- I slept better

This change directly led to better habits described in

how I track every rupee I spend.

FAQs (Answered Honestly)

1. Is 3 months emergency fund enough?

Only for very stable jobs.

2. Should students build emergency funds?

Yes, even ₹10,000 helps.

3. Can emergency fund be invested?

No. Liquidity > returns.

4. What if I use it?

Refill immediately.

5. Is FD good for emergency fund?

Only sweep or breakable FD.

6. Should couples have joint emergency fund?

Yes, with transparency.

7. Emergency fund or SIP first?

Emergency fund always first.

Editor’s Pick (Most Important Advice)

👉 Emergency fund is not an investment. It’s protection.

Build it first.

Everything else comes later.

Strong Call To Action

If one unexpected expense can shake your family’s peace, it’s time to prepare before the crisis arrives:

Emergency Fund: How Much an Indian Household Really Needs ↗

Bookmark SaveWithRupee.com

where Indian money advice is practical, emotional, and real — built for real emergencies, real families, and real life.

Disclaimer: This article is based on personal experience and is for educational purposes only. It does not constitute financial, investment, or legal advice. Readers are advised to do their own research or consult a qualified professional before making any financial decisions.