Save ₹5000 every month in India with simple budgeting hacks, daily savings ideas, smart mobile plans, grocery tricks, cashback methods, and Indian lifestyle adjustments for 2025.

🌟 Strong Intro (No Questions)

Saving money has become a survival skill for every Indian household in 2025. Expenses like food delivery, rent, groceries, electricity, tuition fees, mobile recharges, travel, and EMIs continue to rise every year. But even with today’s inflation, the average Indian family can still save ₹5000–₹8000 every single month with simple, practical habits that take less than 10 minutes a day.

Most savings don’t come from big sacrifices—they come from small daily corrections. Smart grocery buying, disciplined digital spending, careful recharge planning, cashback stacking, and eliminating hidden costs can transform your monthly budget without changing your lifestyle. This guide is written for real Indian situations—students, salaried employees, homemakers, and families looking to build stability using practical methods similar to Daily Money Hacks, Best Budgeting Apps and Grocery Saving Guide.

📌 Key Takeaways

- Saving ₹5000 a month requires only ₹165 per day.

- You don’t need to cut out fun—just reduce hidden expenses.

- Cashbacks + smart recharges + home meals = highest savings.

- Grocery planning alone saves ₹800–₹1500 monthly.

- Controlling small digital purchases reduces spending massively.

- Saving money becomes automatic once you follow a daily routine.

📚 Table of Contents

- 💸 Why Saving ₹5000/Month Is Easier in 2025

- 🧾 Where Indians Overspend Without Realizing

- 💡 The 15 Most Effective Money-Saving Hacks

- 🪜 Step-by-Step Monthly Savings Plan

- 🛍 Smart Grocery & Kitchen Saving Tips

- 📱 Mobile Recharge, Cashback & UPI Tricks

- 🚗 Daily Commuting & Travel Savings

- 🍽 Food Delivery Cost Reduction

- 👪 Real-Life Indian Examples

- 📊 Savings Comparison Tables

- 👍 Pros & Cons of Different Saving Methods

- ❌ Common Mistakes to Avoid

- 🛠 Best Tools & Apps to Automate Savings

- 🎯 Who This Guide Is For

- ✔️ Quick Action Checklist

- ❓ FAQs

- 🏁 Final Summary

💸 Why Saving ₹5000/Month Is Easier in 2025

Saving money in India today is more about “optimizing” than “cutting down.”

Three things work in your favor in 2025:

- Tons of free UPI cashback apps

- Data-heavy affordable mobile plans

- Cheap home-cooked meal options

- Budgeting apps that organize spending

- Online shopping tricks that reduce prices

A family using even 5–6 of these techniques saves more than ₹5000 each month—without sacrificing comfort or lifestyle.

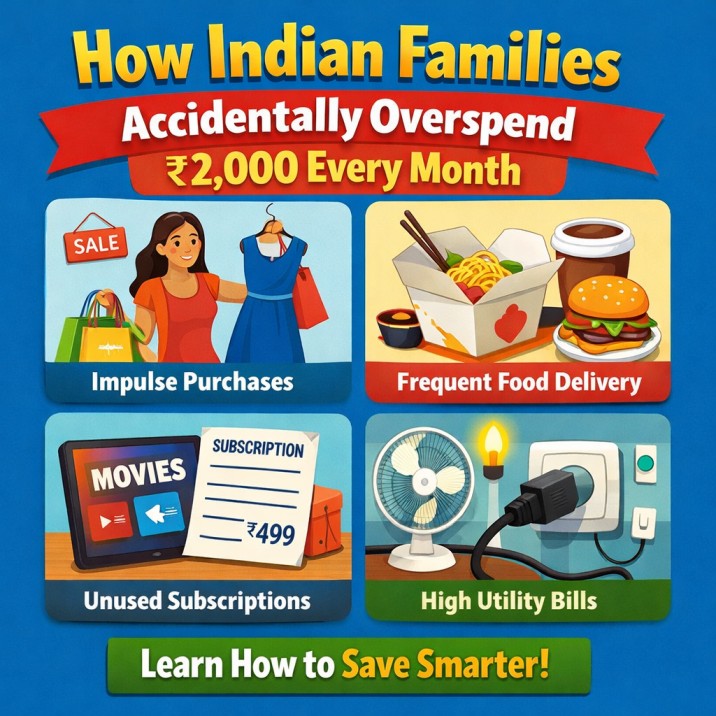

🧾 Where Indians Overspend Without Realizing

These silent expenses kill your savings:

- Frequent food delivery (₹1200–₹3000/month)

- Extra data packs (₹249–₹399/month)

- Grocery waste (₹400–₹800/month)

- Mobile recharge mistakes (₹150–₹300/month)

- Random online impulse purchases (₹500–₹1500/month)

- Daily travel costs (₹400–₹1200/month)

- Electricity misuse (₹300–₹600/month)

This guide fixes each one step-by-step.

💡 The 15 Most Effective Money-Saving Hacks (2025 Edition)

⭐ 1. Apply the “6-Expense Rule”

You only need to reduce these 6 expenses:

- food delivery

- groceries

- electricity

- mobile recharge

- travel

- small online purchases

This alone saves ₹3000–₹6000.

⭐ 2. Switch to Home Meals 5 Days a Week

Follow the simple healthy meals from:

Cheapest Healthy Meals 2025

Savings: ₹600–₹1500/month

⭐ 3. Fix Mobile Recharge Leakage

Choose value plans using:

Recharge Saving Tips

and

Jio vs Airtel vs Vi Guide

Savings: ₹150–₹400/month

⭐ 4. Use Food Delivery Hacks

Refer:

Save on Zomato & Swiggy

Savings: ₹500–₹1200/month

⭐ 5. Use UPI Cashback Apps

Using cashback + scratch cards gives free money every month.

Savings: ₹50–₹300

⭐ 6. Grocery List + Weekly Shopping

This is one of the strongest money-saving habits.

Pair with:

Grocery Saving Guide

Savings: ₹800–₹1500/month

⭐ 7. Electricity Cost Control

Use no-cost hacks from:

Electricity Bill Hacks

Savings: ₹300–₹600/month

⭐ 8. Stop Auto-Debit Subscriptions

Everyone has at least 2–3 unused subscriptions.

Savings: ₹150–₹300/month

⭐ 9. Shift to Low-Cost Travel Whenever Possible

- Metro

- Shares

- EV autos

- Monthly passes

Savings: ₹300–₹1000

⭐ 10. Use Budgeting Apps to Track Spending

Use simple tools from:

Best Budgeting Apps

Savings: ₹300–₹800

⭐ 11. Use Cash for Daily Snacks & Chai

UPI makes overspending easy.

Set a cash limit.

Savings: ₹200–₹400

⭐ 12. Use Cashback Points Smartly

Cashback from Paytm/Fastag/Rewards = mini savings.

⭐ 13. Buy Essentials in Mini Bulk (Not Big Bulk)

Helps reduce wastage + cost.

⭐ 14. Avoid Lifestyle Purchases Before Salary Week

The last 10 days decide your savings.

⭐ 15. Use “₹100 Daily Saving Rule”

Refer:

Save ₹100 Daily Challenge

Savings: ₹3000 per month

🪜 Step-by-Step Monthly Savings Plan

Week 1

Fix mobile recharges + reduce delivery frequency.

Week 2

Set grocery list + buy staple items.

Week 3

Control electricity + track expenses.

Week 4

Review subscriptions + adjust daily spending.

After 30 days, saving ₹5000 becomes automatic.

🛍 Smart Grocery & Kitchen Saving Tips

- Use weekly shopping (makes budgeting easy)

- Don’t buy snacks from online apps

- Use a 7-day meal plan

- Stick to dal-rice-roti basics

- Buy vegetables from local mandis

Pairs with:

Healthy Cheap Home Meals

📱 Mobile Recharge + Cashback Tricks

- Use combined offers

- Prefer telecom apps for discounts

- Avoid unnecessary top-ups

- Redeem UPI scratch cards

- Compare plans before buying

Pair with:

Jio vs Airtel vs Vi 2025

🚗 Daily Commuting & Travel Savings

- Avoid peak-hour rides

- Use metros & trains

- Use EV ride options

- Share rides with colleagues

- Use monthly passes

🍽 Food Delivery Cost Reduction

Refer the full savings guide:

Save on Swiggy & Zomato

Key ideas:

- Avoid peak hours

- Use wallet cashback

- Order combos

- Skip packaging fees

Savings: ₹500–₹1200/month

👪 Real-Life Indian Stories

👩💼 Ritu, Gurgaon

Reduced food delivery → saved ₹900/month.

👨🎓 Vivaan, Bangalore

Used grocery budgeting → saved ₹1400/month.

👨👩👧👦 Sharmas, Pune

Used family mobile plan → saved ₹350/month.

📊 Savings Comparison Table

| Category | Monthly Savings |

|---|---|

| Food delivery | ₹500–₹1500 |

| Groceries | ₹800–₹1500 |

| Travel | ₹300–₹1000 |

| Mobile recharge | ₹150–₹400 |

| Electricity | ₹300–₹600 |

| Subscriptions | ₹150–₹300 |

Total Potential: ₹2200–₹5000+

👍 Pros & Cons of Saving ₹5000/Month

✔️ Pros

- No lifestyle compromise

- Builds emergency fund

- Reduces financial stress

- Improves control over spending

❌ Cons

- Requires consistency

- Takes 2–4 weeks to adjust

- Not possible if overspending on luxury items

❌ Common Mistakes People Make

- Tracking savings for only 7 days

- Relying too much on food delivery

- Ignoring small daily expenses

- Buying unnecessary subscriptions

- Overspending after payday

🛠 Best Tools & Apps to Automate Savings

- Monefy

- Spendee

- Google Sheets

- Paytm Cashback

- PhonePe Rewards

Also see:

Best Budgeting Apps 2025

🎯 Who This Guide Is For

- Students

- Young earners

- Middle-class families

- Working professionals

- Homemakers managing budgets

- Anyone trying to build their first savings habit

✔️ Quick Action Checklist

- Fix mobile recharge issues

- Reduce delivery orders

- Weekly grocery shopping

- Use UPI cashback

- Track spending daily

- Follow ₹100-per-day saving rule

❓ FAQs

1. Is saving ₹5000 per month realistic in India?

Yes, most families can do it easily with small adjustments.

2. How can students save ₹5000?

Food + travel + mobile recharge optimization.

3. What if my salary is low?

Follow small-salary strategies:

Save on Small Salary

🏁 Final Summary

Saving ₹5000 every month in India is not only possible—it’s easily achievable with small, consistent habits. By controlling food delivery, optimizing grocery spending, choosing the right mobile plans, reducing travel costs, and using budgeting apps, any household can build strong monthly savings without giving up comfort. With the right strategy, saving becomes automatic, effortless, and sustainable throughout the year.

Disclaimer: This article is based on personal experience and is for educational purposes only. It does not constitute financial, investment, or legal advice. Readers are advised to do their own research or consult a qualified professional before making any financial decisions.