Understand the 50-30-20 rule for Indian families in 2025. Learn how to divide income smartly between needs, wants, and savings — with real examples, tools, and tips.

📋 Table of Contents

- 🧮 What Is the 50-30-20 Rule?

- Why This Budgeting Rule Fits the Indian Middle Class

- 💡 How to Calculate Your 50-30-20 Budget Step-by-Step

- 📊 Example: Family with ₹60,000 Monthly Income

- 🧠 Benefits of Following the 50-30-20 Rule in 2025

- 🧾 Common Mistakes Indians Make While Budgeting

- 💼 How to Customize This Rule for Your Lifestyle

- 🔗 Internal SaveWithRupee Guides to Build a Smarter Budget

- ⭐ Editor’s Pick – SaveWithRupee Team Recommends

- ❓ Frequently Asked Questions (FAQs)

- 🧭 Final Word – Budget Smart, Live Free

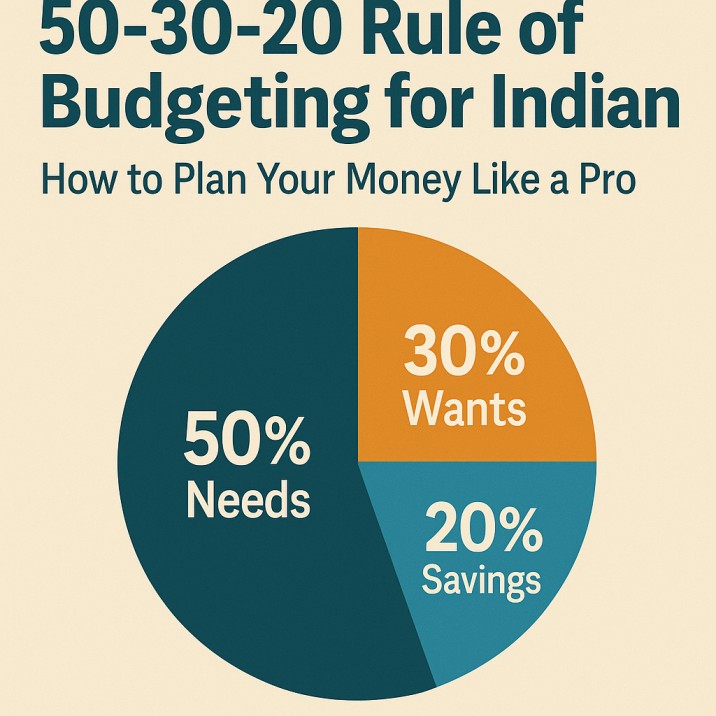

🧮 1. What Is the 50-30-20 Rule?

The 50-30-20 rule is one of the simplest and most effective budgeting frameworks in the world.

It divides your net income (after tax) into three parts:

| Category | Purpose | Recommended % |

|---|---|---|

| 🏠 Needs | Rent, food, EMIs, bills | 50% |

| 🎉 Wants | Dining out, entertainment, shopping | 30% |

| 💰 Savings & Investments | SIPs, FDs, insurance, emergency fund | 20% |

💬 In short: Spend smart, enjoy life, and invest for the future.

It’s not about restricting yourself — it’s about controlling money before it controls you.

🇮🇳 2. Why This Budgeting Rule Fits the Indian Middle Class

India’s middle class is the backbone of the economy — hardworking, aspirational, and always juggling multiple responsibilities.

The 50-30-20 rule fits perfectly because:

✅ It balances lifestyle and savings — no extreme frugality.

✅ It helps plan for irregular incomes (bonus, festival expenses).

✅ It’s adaptable to small-town or metro living.

For example, a family following this rule can easily create an Emergency Fund and still enjoy occasional luxuries like weekend outings.

💡 3. How to Calculate Your 50-30-20 Budget Step-by-Step

Let’s break it down:

Step 1: Identify Monthly Net Income

Include all earnings — salary, freelancing, or side hustles.

💼 Read: Best Side Hustles in India 2025 to add extra cash flow.

Step 2: Allocate 50% for Needs

This includes essentials:

- House rent/loan

- Groceries

- Utilities (electricity, water, mobile recharge)

- Transport/fuel

- School fees

💡 Control costs using How to Reduce Your Electricity Bill in India 2025.

Step 3: Allocate 30% for Wants

Enjoy guilt-free spending — movies, travel, or eating out.

Just cap it at 30%.

Use rewards and cashback to stretch this section:

👉 How to Earn ₹500 Daily with Cashback Apps.

Step 4: Allocate 20% for Savings & Investments

Start SIPs, build your emergency fund, or invest in low-cost schemes.

Use tools from Best Free Budgeting Apps in India 2025 Edition to track.

📊 4. Example: Family with ₹60,000 Monthly Income

| Category | % | Amount (₹) | Example Expenses |

|---|---|---|---|

| Needs | 50% | ₹30,000 | Rent (12k), groceries (8k), bills (5k), transport (5k) |

| Wants | 30% | ₹18,000 | Dining out, OTT, kids’ hobbies, weekend trips |

| Savings/Investments | 20% | ₹12,000 | SIP (₹5000), RD (₹2000), insurance (₹3000), emergency fund (₹2000) |

💬 Even on ₹60k income, this family can save ₹1.44 lakh/year while living comfortably.

If your income is lower, use 60-20-20 (more for needs).

If higher, shift to 40-30-30 to build wealth faster.

🧠 5. Benefits of Following the 50-30-20 Rule in 2025

✅ Simple & Visual: Easy to understand, no complex formulas.

✅ Builds Discipline: Automates savings without thinking.

✅ Balances Lifestyle: You can spend freely without guilt.

✅ Financial Awareness: Makes you conscious of where every rupee goes.

✅ Helps Beat Inflation: Prioritizing investing ensures your money grows faster than expenses.

💡 Combine this method with Smart Investment Habits of Middle-Class Indians for maximum growth.

🧾 6. Common Mistakes Indians Make While Budgeting

- Mixing Needs & Wants:

Buying a new phone “because you need it” — but do you really? - No Emergency Fund:

One medical bill can destroy a year’s savings. Build yours first. - Ignoring Small Recurring Charges:

Netflix, OTT, and app subscriptions quietly eat ₹1000+/month.

See: Hidden Bank Charges You’re Paying Every Month. - Not Tracking Spends:

You can’t fix what you don’t measure.

Use free tools from Best Budgeting Apps in India. - Neglecting Insurance:

Don’t forget — savings vanish fast without protection.

Check: How to Save on Insurance Premiums.

💼 7. How to Customize This Rule for Your Lifestyle

The 50-30-20 rule is flexible — here’s how to tweak it:

| Life Stage | Custom Ratio | Example Focus |

|---|---|---|

| Students | 60-20-20 | Lower income, fewer bills |

| Newly Married Couples | 45-25-30 | Focus on investments |

| Families with Kids | 55-25-20 | Education + EMIs |

| Retirees | 40-30-30 | Healthcare & stability |

| Freelancers/Self-employed | 40-40-20 | Variable income; save more |

Adapt, don’t abandon. The key is consistency.

💬 Budgeting is personal — the math stays, the meaning changes.

🔗 8. Internal SaveWithRupee Guides to Build a Smarter Budget

- Monthly Budget Plan for Family with ₹30,000 Income

- Why Family Budget Plan Is Important

- 15 Daily Money Hacks to Save ₹10,000 This Year

- 10 Lifestyle Changes That Will Save You Money in 2025

- Best Low-Cost Saving Schemes in India 2025

⭐ 9. Editor’s Pick – SaveWithRupee Team Recommends

🟢 Smart Investment Habits of Middle-Class Indians – Build Wealth Step-by-Step

📈 Learn to grow your savings into real assets.

🟢 Passive Income Ideas in India 2025 – Make Money While You Sleep

💤 Convert your savings into recurring income.

🟢 Hidden Bank Charges You’re Paying Every Month – Stop Losing Money in 2025

⚠️ Keep your hard-earned rupees safe from invisible deductions.

🟢 Best Side Hustles in India 2025 – Earn ₹10,000/Month

💼 Boost your income to strengthen your budget.

🟢 Emergency Fund – How Much Should You Keep?

💰 Protect your family from financial shocks.

❓ 10. Frequently Asked Questions (FAQs)

Q1. How does the 50-30-20 rule work for irregular income?

If your income varies, average your last 3 months and use 50-30-20 as a flexible guide — invest only after covering essentials.

Q2. What if my needs exceed 50% of income?

Shift to 60-20-20 temporarily, then reduce EMI, rent, or bills over time.

Q3. Can I apply this rule with my spouse’s income?

Yes — combine both incomes and categorize total expenses under the same rule.

Q4. How can students use this rule?

Use 60-20-20: 60% for study/living costs, 20% for enjoyment, 20% savings (even ₹500 SIP counts).

Q5. Is this rule suitable for small-town India?

Absolutely. It’s even easier to follow since expenses are lower. You can save more (up to 30%).

Q6. Should I count loan EMIs under needs or savings?

Home/car EMIs count as “needs” since they’re fixed obligations. But investments like SIPs or RDs go under “savings.”

🧭 11. Final Word – Budget Smart, Live Free

A good budget doesn’t feel like punishment — it feels like control.

When you give every rupee a purpose, you never wonder “where did my money go?” again.

💬 Start this month — open a notebook or budgeting app, note your income, and apply the 50-30-20 rule.

Within three months, you’ll notice your savings growing without cutting joy.

The secret isn’t earning more — it’s managing better.

💚 SaveWithRupee Says:

“A budget isn’t about limitation — it’s about freedom.”

Next, read:

👉 Smart Investment Habits of Middle-Class Indians – Build Wealth Step-by-Step in 2025

and

👉 Passive Income Ideas in India 2025 – Make Money While You Sleep

Disclaimer: This article is based on personal experience and is for educational purposes only. It does not constitute financial, investment, or legal advice. Readers are advised to do their own research or consult a qualified professional before making any financial decisions.