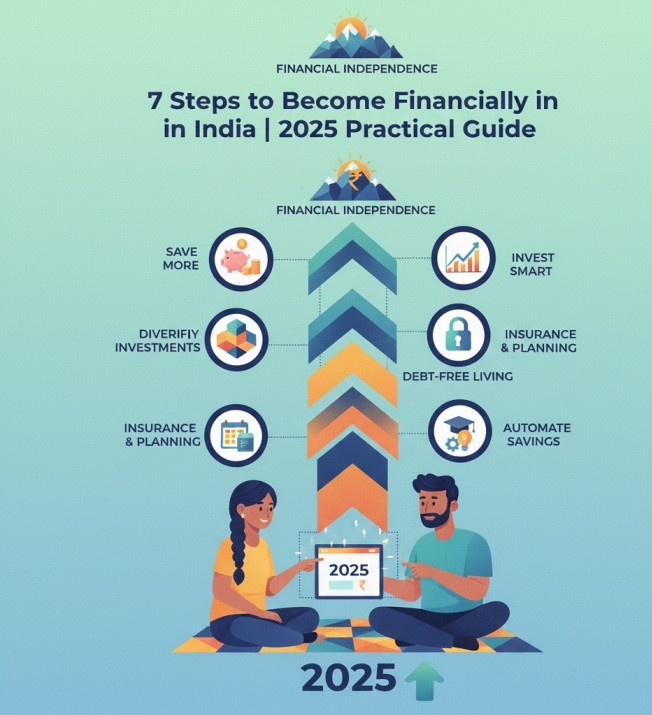

A simple and practical 7-step guide for becoming financially independent in India in 2025. Includes real stories, budgeting tips, savings systems, investment habits, and internal SaveWithRupee links.

🔥 Strong Intro (No Questions)

Financial independence is not about becoming rich overnight—it’s about gaining the freedom to make life choices without money controlling every decision. For most Indians, this journey begins with simple steps: earning better, saving consistently, avoiding debt traps, building emergency cushions, and slowly investing with discipline.

This guide is written in a practical, Indian-friendly style so anyone—student, housewife, employee, or small-business owner—can walk the path to financial stability and long-term independence.

⭐ Key Takeaways

- Financial independence is built through consistent monthly habits.

- Saving is important, but eliminating high-interest debt is even more powerful.

- Small investments, done regularly, become wealth in 5–10 years.

- Every Indian household needs an emergency fund.

- You don’t need a high salary—you need high discipline.

📚 Table of Contents (Numbered)

- 🎯 Understand What Financial Independence Really Means

- 💸 Step 1: Track Every Rupee You Spend

- 📉 Step 2: Destroy High-Interest Debt

- 💰 Step 3: Save Your First ₹1 Lakh

- 🥘 Step 4: Build a 6-Month Emergency Fund

- 📈 Step 5: Start Small Investments (SIP, FD, Gold)

- 🚀 Step 6: Build Skills & Side Income

- 🧘 Step 7: Protect Yourself With Insurance & Discipline

- 🧑💼 Real Indian Stories

- 🔍 Comparison Table: Salary vs Wealth

- 👍 Pros & Cons of the FI Journey

- ⚠ Common Mistakes Indians Make

- 🛠 Tools & Apps to Help You

- 🔗 Helpful Internal Links

- 👪 Who This Guide Is For

- 📌 Quick Start Checklist

- ❓ FAQs

- 🧩 Final Summary

🎯 1. Understand What Financial Independence Really Means

Financial independence for Indians means:

- Your income is more than your monthly expenses

- You don’t depend on loans or credit cards

- You have savings for emergencies

- You earn from multiple sources, not just salary

- Your investments grow quietly in the background

It’s a slow, steady process—not a single event.

💸 2. Step 1: Track Every Rupee You Spend

The foundation of financial independence starts with awareness.

Track:

- UPI payments

- Food delivery

- Groceries

- Transport

- Recharge plans

- Mini impulsive expenses

Most Indians overspend ₹2,000–₹5,000 per month without realising it.

Helpful guide:

Grocery Shopping Tips to Cut Monthly Expenses

Simple ways to track spending:

- WhatsApp notes

- Google Sheets

- Budget apps

- Daily UPI check

📉 3. Step 2: Destroy High-Interest Debt

Debt is the biggest enemy of financial independence.

High-interest debt includes:

- Credit card balances

- Loan apps

- BNPL (Buy Now Pay Later)

- Overdue EMIs

These trap Indians in long cycles of guilt and financial stress.

Solution guide:

Credit Card Debt in India – Smart Plan to Pay Off

The strategy:

- Pay the highest-interest loan first

- Stop using credit card until cleared

- Avoid minimum payments—they are a trap

- Increase your EMI slightly each month

💰 4. Step 3: Save Your First ₹1 Lakh

Savings = Confidence + Stability.

A target of ₹1 lakh gives emotional and financial peace.

Step-by-step guide:

How to Save Your First ₹1 Lakh

How to save ₹1 lakh:

- Save ₹5,000–₹8,000 monthly

- Cut food delivery

- Avoid luxury spends

- Stick to budget meals

- Use cashback wisely

7 Best Cashback Apps

Even if you earn ₹20,000–₹30,000, it is still possible.

🥘 5. Step 4: Build a 6-Month Emergency Fund

This is your safety cushion.

Emergency fund covers:

- Rent

- Groceries

- Medicines

- School fees

- Transport

Guide:

Emergency Fund Guide for Indian Families

Start with:

- ₹1,000–₹2,000 per month

- Use FDs or liquid funds

- Don’t touch unless necessary

Without an emergency fund → financial independence collapses.

📈 6. Step 5: Start Small Investments (SIP, FD, Gold)

Investing is where real wealth builds.

Best beginner options:

- SIP starting ₹500/month

- FD for stable returns

- Digital gold for long-term

- PPF for tax-free growth

Investment guide:

SIP for Beginners Starting with ₹500

Use the 50-30-20 rule:

50% → needs

30% → wants

20% → savings + investments

Guide:

50-30-20 Rule Explained for Indians

🚀 7. Step 6: Build Skills & Side Income

One income is risky.

Two incomes bring independence.

Three incomes bring freedom.

Choose side income based on interest:

- Freelancing

- Editing / writing

- Online tutoring

- Graphic designing

- Delivery partner

- Affiliate marketing

- Selling digital products

Guide:

10 Side Hustles for Indians in 2025

Extra ₹5,000–₹20,000 monthly can speed up your FI journey.

🧘 8. Step 7: Protect Yourself With Insurance & Discipline

Indians often ignore protection until it’s too late.

You need:

- Term insurance (if family depends on income)

- Health insurance

- Regular budget tracking

- Zero impulsive spending

- Annual financial check-up

Insurance saving hacks:

How to Save on Insurance Premiums

🧑💼 9. Real Indian Stories

⭐ Story 1: Sandeep, 28 – Hyderabad

Salary: ₹32,000

He cut food delivery and used ₹100 daily savings to invest in SIPs.

Today he has ₹1.8 lakh in savings + mutual funds.

⭐ Story 2: Renu, 35 – Jaipur (Single Mother)

She used the 50-30-20 rule, cleared credit card debt, and started tiffin service.

Now earns ₹12,000 extra per month and is debt-free.

⭐ Story 3: Aman, 22 – Delhi Student

Started freelancing on weekends.

Earning: ₹8,000–₹15,000 monthly.

Invests ₹1,000 in SIP every month.

🔍 10. Comparison Table: Salary vs Wealth

| Point | Salary | Wealth |

|---|---|---|

| Stability | Monthly | Long-term |

| Growth | Slow | Compounding |

| Emotional Peace | Medium | High |

| Impact | Short-term | Life-changing |

| Independence | Low | Very high |

👍 11. Pros & Cons of the FI Journey

Pros

- Zero money stress

- Freedom to choose jobs

- Better family life

- Emergency protection

- Long-term security

Cons

- Requires discipline

- Slow process

- Temptations everywhere

- Needs consistent effort

⚠ 12. Common Mistakes Indians Make

- Using credit cards for survival

- No emergency fund

- Depending on one income source

- Investing without research

- Falling for high-return scams

- Not tracking daily UPI expenses

🛠 13. Tools & Apps to Help You

- Money Manager

- Notebook or Google Sheets

- WhatsApp notes for daily tracking

- Paytm/PhonePe for spending categories

- Mutual fund apps

- Budgeting apps

Best Free Budgeting Apps

🔗 14. Helpful Internal Links

👪 15. Who This Guide Is For

- Young professionals

- Families with limited income

- Students starting their career

- Homemakers planning savings

- Anyone stuck in financial stress

- Anyone who wants stability and confidence

📌 16. Quick Start Checklist

- Track expenses for 30 days

- Cut unnecessary spending

- Clear high-interest debt

- Save ₹5,000 monthly

- Build a 6-month emergency fund

- Start SIP of ₹500–₹2000

- Build a side income

- Stay consistent for 12 months

❓ 17. FAQs

Q1: How long does it take to become financially independent?

Usually 2–5 years depending on income and discipline.

Q2: Can low-income families also achieve FI?

Yes—slowly but surely.

Q3: Is investing necessary?

Yes—savings alone cannot build wealth.

Q4: Which investment is safest?

SIP + FD + PPF combination is safest for beginners.

🧩 Final Summary

Financial independence is not a dream reserved for rich people—it is a habit reserved for disciplined people. By tracking expenses, killing debt, saving consistently, building an emergency fund, investing regularly, and growing side income, every Indian can create long-term stability and freedom.

Start small. Stay steady. Watch your financial life transform.

Disclaimer: This article is based on personal experience and is for educational purposes only. It does not constitute financial, investment, or legal advice. Readers are advised to do their own research or consult a qualified professional before making any financial decisions.