Middle-class Indian families often feel shocked at year-end savings — not because of big expenses, but due to small monthly costs they never track. This guide uncovers the hidden expenses silently draining your money and shows how to stop them in 2026

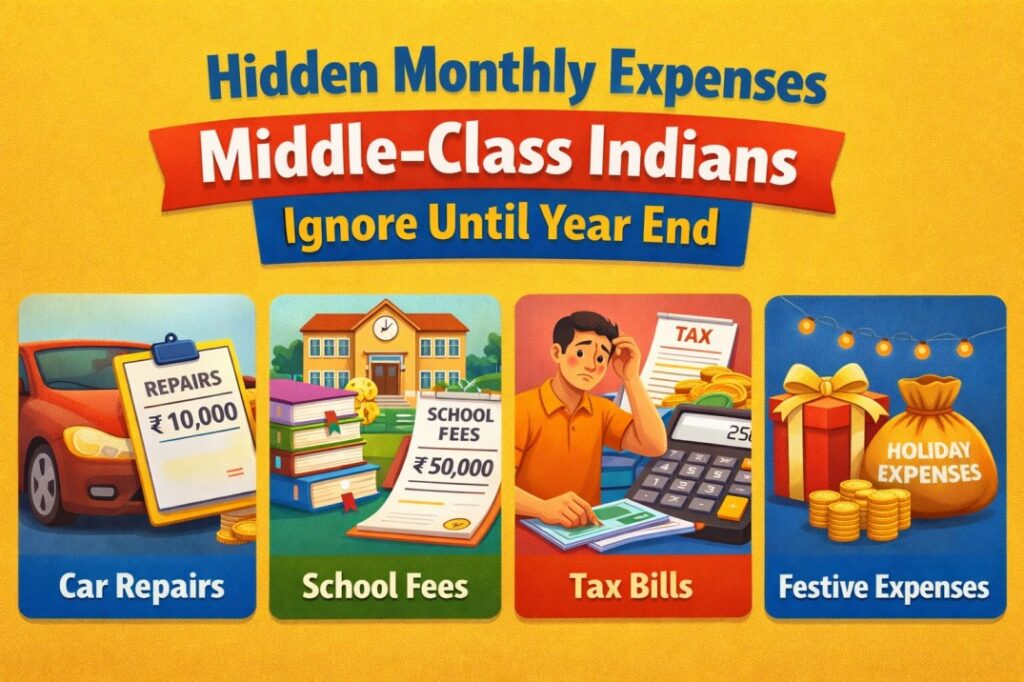

Hidden Monthly Expenses Middle-Class Indians Ignore Until Year End

Every December, the same thought hits many Indian households:

“Salary toh aayi thi… phir paisa gaya kahan?”

There was no foreign trip.

No luxury shopping.

No major medical emergency.

Yet savings look disappointing.

The reason is simple — hidden monthly expenses. These are not big enough to scare you in the moment, but when added over 12 months, they quietly eat ₹20,000–₹60,000 from a middle-class family.

In 2025, when inflation is already tight, ignoring these expenses is no longer affordable.

Let’s break down the real culprits — the ones most Indian families don’t even count as expenses.

Why These Expenses Go Unnoticed All Year

Middle-class spending in India has three traits:

- Many small digital payments (UPI, cards, auto-debits)

- Expenses spread across the month

- No single “big bill” to alert you

Because of this, money leaks quietly. Awareness usually comes only at:

- Year-end savings review

- Tax planning time

- Festival season cash crunch

By then, the damage is already done.

1. Food Delivery & Outside Snacks (₹800–₹1,500/month)

This is the biggest silent drain.

Most families budget groceries properly — but outside food is treated as “extra”, not an expense.

Examples:

- Evening snacks from bakery

- “Let’s order today” weekends

- Office-time tea, samosa, coffee

₹100 here, ₹150 there feels harmless.

But yearly impact:

- ₹1,000/month × 12 = ₹12,000

This is why many families struggle despite careful grocery planning, as explained in groceries budget shopping – smart ways to save every month.

2. Convenience Fees & Small Charges (₹300–₹600/month)

Convenience fees are designed to feel invisible.

Examples:

- Delivery charges

- Platform fees

- Late-night surcharge

- Ticket booking convenience fees

Each one looks tiny. Together, they quietly cross ₹500 monthly.

Over a year:

- ₹6,000 gone — without buying anything extra.

3. Subscriptions You Forgot About (₹200–₹500/month)

OTT apps, music apps, cloud storage, learning apps.

Most families:

- Subscribe during offers

- Forget renewal dates

- Don’t review statements carefully

Even 2 unused subscriptions:

- ₹199 + ₹299 = ₹498/month

- Nearly ₹6,000 a year

This problem shows up clearly when families start reviewing their monthly money flow, like in how I track every rupee I spend.

4. Bank Charges & Penalties (₹150–₹400/month)

Banks rarely warn you clearly.

Hidden costs include:

- Minimum balance penalties

- ATM charges

- SMS alert fees

- Debit card annual charges

Because these are auto-deducted, people don’t emotionally “feel” the expense.

But yearly damage:

- ₹3,000–₹5,000 silently gone

Many families discover this too late, as explained in hidden bank charges you’re paying every month.

5. Impulse Online Purchases (₹500–₹1,000/month)

“Deal achha hai.”

“Baad mein kaam aa jayega.”

“It’s just ₹299.”

Online shopping removes spending pain.

Unplanned buys:

- Clothes

- Kitchen gadgets

- Small electronics

- Discounted items not actually needed

One or two such purchases monthly quietly cost ₹1,000.

Shopping with awareness reduces this significantly, as shown in best online shopping tricks to save money.

6. Electricity & Utility Overuse (₹300–₹700/month)

This isn’t about luxury usage.

It’s about:

- Fans left on

- Extra lights

- Idle charging

- Old appliances

These don’t feel like “spending”, but the bill proves otherwise.

Over a year:

- ₹500/month = ₹6,000 wasted

Simple awareness saves money, as explained in electricity bill hacks to save ₹1,000 every month.

7. Festivals & Small Social Spending (₹300–₹800/month averaged)

Indians don’t spend evenly on festivals.

But averaged monthly:

- Gifts

- Office collections

- Small family functions

- Last-minute shopping

Because these expenses are irregular, they’re rarely budgeted.

Over a year, they quietly drain savings.

What These “Small” Expenses Really Add Up To

Let’s take a conservative estimate:

- Food & snacks: ₹1,000

- Convenience fees: ₹400

- Subscriptions: ₹400

- Bank charges: ₹300

- Impulse shopping: ₹800

- Utilities overuse: ₹500

Total hidden expense: ₹3,400 per month

That’s:

- ₹40,000+ per year

- Enough for emergency fund

- Enough for a solid SIP

- Enough to reduce stress significantly

Why Middle-Class Families Realise This Only at Year End

Because:

- Salary comes regularly

- Expenses feel manageable

- No one big “shock” appears

But savings quietly suffer.

This is why year-end regret is common, especially when reviewing goals, taxes, or long-term plans.

How to Stop These Expenses Without Extreme Budgeting

You don’t need strict rules.

You need visibility.

1. Track “Small Expenses” Separately

Not rent. Not school fees.

Only expenses under ₹200.

Awareness itself cuts spending.

2. Weekly Money Review (10 Minutes)

Weekly reviews catch leaks early — monthly reviews don’t.

This method works better for families, as explained in weekly budget vs monthly budget – which works better.

3. Redirect Saved Money Immediately

Move saved money to:

- SIP

- RD

- Emergency fund

If money stays idle, it gets spent again.

This simple habit is explained well in how to save ₹5,000 every month without sacrifice.

FAQs

1. Are these expenses unavoidable?

No. Most are habit-based, not necessity-based.

2. Should I stop all outside spending?

No. Reduce frequency, not enjoyment.

3. Do small expenses really matter?

Yes. Small expenses repeated daily hurt more than big one-time costs.

4. How long before I see improvement?

Most families notice savings within 30–45 days.

5. Can low-income families benefit from this?

Yes. The lower the income, the more powerful leak-fixing becomes.

Final Thoughts

Middle-class Indians don’t overspend because they’re careless.

They overspend because small expenses feel invisible.

In 2025, financial improvement won’t come from earning dramatically more.

It will come from not letting money quietly slip away.

Fix the leaks early —

so December doesn’t come with regret again.

Disclaimer: This article is based on personal experience and is for educational purposes only. It does not constitute financial, investment, or legal advice. Readers are advised to do their own research or consult a qualified professional before making any financial decisions.