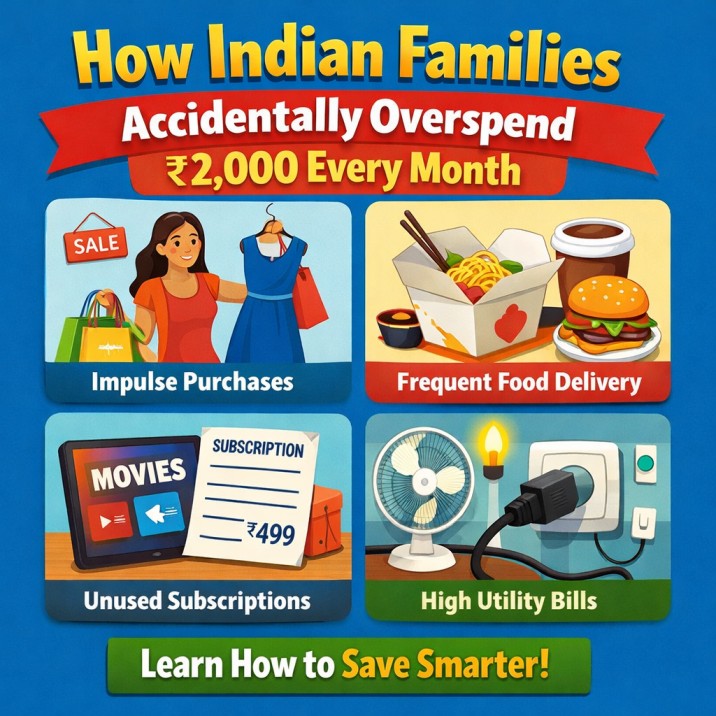

Indian families lose thousands every month without noticing. Discover hidden money leaks, real stories, mistakes, and a simple roadmap to stop silent losses.

💸 Where Most Indian Households Lose Money Without Realising

(Silent leaks that quietly drain your hard-earned income)

Let me ask you something honestly:

Have you ever felt that money just disappears…

without knowing exactly where it went?

Salary comes.

Bills get paid.

Life goes on.

But savings don’t grow.

Stress quietly increases.

And you keep thinking — “Pata nahi paisa kahan chala jaata hai.”

This article exists because most Indian households don’t lose money in big mistakes.

They lose it in:

- Small daily habits

- Silent charges

- Emotional spending

- Unplanned decisions

Individually harmless.

Together — financially dangerous.

🙋♂️ Why You Should Trust This Article

My name is H. Suresh,

founder of SaveWithRupee.com, based in Chennai, Tamil Nadu.

For over 10 years, I’ve studied:

- Middle-class Indian money habits

- Household budgeting failures

- Silent financial leaks

- Real-life money stress stories

Smarter Money. Better Life. One Rupee at a Time.

Everything below is something I’ve:

- Personally experienced

- Seen in Indian families

- Helped readers fix

🧠 The Biggest Truth About Money Loss in India

Here’s the uncomfortable truth:

Most Indian households are not careless.

They are just unaware.

Money doesn’t disappear overnight.

It leaks slowly — silently.

Let’s expose those leaks.

🚨 12 Places Where Indian Households Lose Money (Without Realising)

1️⃣ Keeping Too Much Money in Savings Accounts

This is the biggest silent loss.

Most families feel safe when money sits in a savings account.

But reality?

| Factor | Savings Account |

|---|---|

| Interest | 2–3% |

| Inflation | 5–6% |

| Real return | ❌ Negative |

You’re not growing money.

You’re losing purchasing power every year.

👉 Related guide:

Government Schemes Indians Ignore That Quietly Beat Bank Savings

😔 Real-Life Story #1: Uncle Srinivasan (Retired, Chennai)

He kept ₹8 lakh in savings “for safety”.

After years:

- Interest earned = small

- Medical costs increased

- Money felt insufficient

“Safe lag raha tha… par badh hi nahi raha.”

2️⃣ Not Tracking Daily Expenses

₹100 chai

₹150 snacks

₹300 delivery

These don’t hurt once.

But monthly?

They bleed money.

Why this happens:

- No expense tracking habit

- “It’s just a small amount” thinking

👉 My turning point:

How My Life Changed After Tracking My Expenses

3️⃣ Subscriptions Nobody Uses

OTT apps.

Music apps.

Cloud storage.

Fitness apps.

Most families pay for at least 3–5 unused subscriptions.

₹199 + ₹299 + ₹499 = big yearly waste.

👉 Connected issue:

Hidden Bank Charges You’re Paying Every Month

4️⃣ Emotional Spending (India’s Biggest Blind Spot)

Stress → food delivery

Boredom → shopping

Festivals → overspending

Social pressure → gifting

This money leak is emotional, not logical.

😔 Real-Life Story #2: Rekha (Working Mother)

“Shopping mujhe khushi deta tha… baad mein guilt.”

Money spent emotionally is rarely remembered — but always felt later.

5️⃣ Buying on EMI Without Planning

EMIs feel small.

But multiple EMIs = permanent stress.

Phone EMI

TV EMI

Furniture EMI

Income gets pre-booked before you earn it.

👉 Must read:

Personal Loan vs Overdraft vs Loan Apps

6️⃣ Ignoring Insurance (Until It’s Too Late)

Many households delay:

- Health insurance

- Term insurance

One medical emergency can:

- Destroy savings

- Force loans

- Create long-term stress

👉 Practical guide:

How to Save on Insurance Premiums

😔 Real-Life Story #3: Raghav (Small Business Owner)

No health insurance.

One hospital bill.

Years of recovery.

“Jo bachaya tha, sab chala gaya.”

7️⃣ Festival Spending Without Planning

Festivals are emotional in India.

Diwali.

Pongal.

Weddings.

Without planning:

- Credit cards suffer

- Savings vanish

- Guilt follows celebration

👉 Smart help:

Best Diwali Shopping Tips – Budget Edition

8️⃣ Not Using Government Schemes Properly

Many families don’t use:

- PPF

- SSY

- SCSS

- NSC

They trust banks blindly and miss better, safer options.

👉 Beginner-friendly:

Best Low-Cost Saving Schemes in India

9️⃣ No Emergency Fund

This is not a “loss” until something happens.

Then it becomes:

- Loan dependency

- Panic

- Bad decisions

👉 Essential reading:

Emergency Fund – How Much Should an Indian Household Keep?

😔 Real-Life Story #4: My Own Experience

One sudden expense.

No proper buffer.

That day taught me:

Emergency fund is not savings.

It’s survival.

(Full story here: What Living Through a Financial Emergency Taught Me About Money)

🔄 10️⃣ Lifestyle Inflation After Salary Hikes

Salary increases → lifestyle upgrades.

Rarely:

- Savings increase equally

- Investments increase first

Result?

Same stress at higher income.

👉 Deep truth:

Why Most Indians Never Feel Rich No Matter How Much They Earn

11️⃣ Not Involving Family in Money Planning

Money secrecy creates:

- Confusion

- Conflict

- Duplication of expenses

Families that talk about money, waste less.

👉 Must read:

Why Family Budget Plan Is Important

12️⃣ Saving After Spending (Classic Indian Mistake)

“End of month jo bachega, save karenge.”

Nothing remains.

Saving must come first, not last.

👉 Life-changing habit:

How to Save ₹5,000 Every Month Without Sacrifice

📊 Silent Loss vs Smart Awareness (Comparison Table)

| Habit | Result |

|---|---|

| No tracking | Money leaks |

| Planned saving | Control |

| Emotional spending | Guilt |

| Conscious spending | Peace |

❌ Myth vs Reality

| Myth ❌ | Reality ✅ |

|---|---|

| Small expenses don’t matter | They matter most |

| Banks protect money | Awareness protects money |

| I earn enough | Habits decide outcome |

| Saving is hard | Wasting is harder |

⚠️ Common Mistakes Indian Households Make

- ❌ No expense tracking

- ❌ Ignoring inflation

- ❌ Too many EMIs

- ❌ No emergency buffer

- ❌ Emotional decisions

👉 Related honesty:

My Biggest Regret About Money

✅ Do vs Avoid Table

| Do ✅ | Avoid ❌ |

|---|---|

| Track expenses | Guess spending |

| Plan festivals | Last-minute splurges |

| Use govt schemes | Only savings account |

| Build emergency fund | Relying on loans |

🪜 Step-by-Step: How to Stop These Money Leaks (30-Day Fix)

Week 1: Awareness

Track everything.

Week 2: Clean Up

Cancel unused subscriptions.

Week 3: Separate Money

Emergency fund + savings.

Week 4: Automate

SIPs + recurring deposits.

👉 Helpful roadmap:

7 Steps to Become Financially Independent

🧾 Household Money Leak Checklist

✔ Expenses tracked

✔ Subscriptions reviewed

✔ Emergency fund started

✔ Insurance active

✔ Savings invested smartly

Tick 3+ → You’re ahead of most households.

👍 Pros & Cons of Becoming Money-Aware

Pros

- More savings

- Less stress

- Better decisions

- Family harmony

Cons

- Initial discomfort

- Honest self-review

- Habit change required

🏆 Editor’s Pick (Most Important Truth)

Money doesn’t disappear.

It escapes where attention is missing.

❓ FAQs (People Ask This Often)

1. Are these leaks really significant?

Yes. Thousands yearly.

2. Can low-income families fix this?

Even more important for them.

3. Do I need apps?

No. Awareness matters more.

4. Should I stop enjoying life?

No. Plan joy, don’t sabotage future.

5. Is savings account useless?

No. Just not for long-term storage.

6. How long to see improvement?

1–3 months.

7. What’s the first step?

Track expenses for 30 days.

❤️ Final Words (Indian Reality Check)

Indian households don’t fail financially because they don’t earn.

They fail because:

- Nobody showed them the leaks

- Life kept moving fast

- Survival took priority

Awareness is powerful.

Once you see the leaks, you can’t unsee them.

That’s why SaveWithRupee.com exists —

to help Indian families keep more of what they earn.

🚀 Strong Call To Action (CTA)

If this article opened your eyes, don’t stop here.

👉 Start with this practical guide today:

How to Save Money on a Small Salary (₹10,000–₹20,000)

Bookmark SaveWithRupee.com

— where Indian money advice is practical, emotional, and real.

Smarter Money. Better Life. One Rupee at a Time. 💚

Disclaimer: This article is based on personal experience and is for educational purposes only. It does not constitute financial, investment, or legal advice. Readers are advised to do their own research or consult a qualified professional before making any financial decisions.